Who would have imagined a shelter-in-place order being implemented across the country for over a month and counting? It is unclear when we will go back to our normal lifestyles, but until then consumers are transitioning almost exclusively to a virtual banking reality. In this new reality, existing digital banking capabilities are being fully exercised, exposing areas of strengths as well as functions and processes that call for improvement. Now more than ever, a bank’s capability to digitally engage with customers to understand and meet their needs is becoming be a top priority.

Banks have been making good progress. According to the J.D. Power 2020 U.S. Retail Banking Advice Satisfaction Study, customer satisfaction with advice and guidance received through digital channels has increased significantly. “Within the next year, digital will surpass the branch as the most commonly used retail banking customer advice channel,” states Paul McAdam, Senior Director of Banking Intelligence at J.D. Power. The current pivot to online and mobile channels will likely multiply the digital adoption rate.

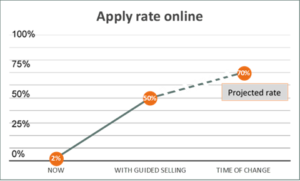

However, the ways in which banks digitally interact with customers for guidance varies dramatically. Those banks using dynamic digital conversations to guide customers to wise financial choices find that customers are 4x more likely to apply for an account. In our new reality we would naturally expect the digital account application rate to increase even more. Those institutions using guided conversation technology will also see an increase in the number of products opened, as consumers needs are more effectively discovered and aligned with the bank’s product offerings.

What about chat and chat bots you might ask? These techniques are certainly effective in limited circumstances, however, having deeper, dynamic conversations as consumers progress through their financial journey, is key to “virtual banking” success.

Transforming into a virtually capable organization requires simplifying all consumer interactions with modern technology, and implementing digital customer engagement tools for products, communication, customer service, and marketing strategies.

A few ideas to effectively accelerate the evolution to a more capable virtual banking environment are:

- Reallocate branch personnel to use digital guides together with clients via phone and video-sharing screens.

- Conduct social media campaigns to drive consumers to your financial institution’s guided conversation channels and links. Self-guidance with understanding and education allows the self-serve user to select a solution with greater confidence that it fits the user’s needs and circumstances.

- Guide consumers to an agent to gain advice to calm nerves and reduce financial uncertainty.

An intelligent digital guidance and engagement system will keep you at the forefront. Consumers who feel heard and are guided to the right solutions drive higher customer satisfaction rates, by as much as 40%.

Ignite Sales wants to help make it easy for financial institutions of all sizes to provide intelligent guided technology to meet the needs and demands of the sheltered virtual consumer. Contact us to find out how we can help you and to schedule a demo.

Be the first to know new insights from Ignite Sales. Subscribe to our blog today.

To read more on these subjects, click here.