It’s all about the data. Make sure yours is meaningful.

Personalizing customer engagement comes in many forms in today’s digital world. There is next best product technology based on transactions or browsing history. There are bots that you can chat with to gather remedial information one simple question at a time. There are digital placemats and matrix tables along with a couple of question paths focused on products. Then there are the AI black boxes filled with unknown data points that serve up solutions. And many more coming on each day. Wow! How can a bank manage all of these differing technologies (and costs) and make inroads in the new personal customer engagement space? And do these offerings really personalize the engagement? Oh, and will they pass the banking compliance test?

All these platforms run on data–different types of data, but data, nonetheless. So, how can you be sure you are personalizing the experience based on good, clean, accurate, and relevant data? ASK the customer! – to gain up-to-the-minute, accurate, needs-driven data. But what do you ask, and how can you do this in an ethically and consistently, digitally? Guided Conversation Technology.

Personalization for the win!

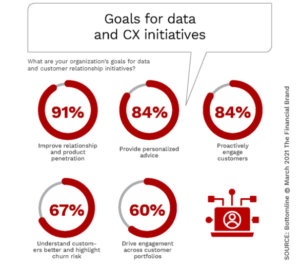

Financial Brand clearly outlined the process 9 Keys to Retail Banking Success article sections 2. Here are the key points they made for intelligent decisioning, guided conversation must-haves that will scale in real-time for truly successful personalized customer engagement experiences.

Financial institutions must move from using data and analytics for great internal reports to using data, analytics, and content for exceptional experiences.

Customers no longer want or need to know what they did [in the past] but are looking for more of a “GPS of financial services” to guide them to recommendations that meet their needs, boost financial wellness, and even warn of potential pitfalls.

Conversation guide platforms check off each of the above must-haves and take it even a bit further. Did you know that 66% of banks use a Banking-as-a-service platform that allows them to be embedded into the customers’ lives? While it is still in its infancy, banks can make inroads into embedding their institutions into customers’ lives by being in their lives in ways that matter. Intelligent conversation guides drive the personalized experience of non-biased, individual needs-based banking with over 10 million customer conversations that produce clean, accurate data and help drive the data-driven intelligent customer engagement platform of the future.

Where to Start

It has never been more important to improve all aspects of customer experience, from the ease of opening an account to anticipating which products and services provide the most value at critical life stages. What has changed is the need – and consumer preference – to execute on these initiatives using digital channels. As noted by Temenos in “Retail Banking Trends and Priorities: February 2021,”

proactive personalization is required. Customers now expect a personalized user experience based on their first-hand, positive exposure to online brands like Amazon, Netflix, Google, and other fintech players.

Personalize the conversation

Personalizing the conversation with customers and prospects are the foundation for deeper and longer lasting relationships with the bank. This goes way beyond using a customer’s name in the conversation. It is, rather, focused on understanding the needs, circumstances, and priorities of the customer by engaging in a dynamic, engaging conversation.

‘Close the CX Gap with data-driven conversation guides leading customer and small businesses to better choices equating to loyalty.’

The more the banker knows about the customer, the better the banker can guide a conversation that most effectively meets the needs of the customer. A robust CRM system clearly helps support the initiation of an effective conversation. However, most CRM systems are not fully populated with the latest information about a customer and therefore provide inconsistent support for an engaging conversation. The same holds true for social media-based information which provides an incomplete, inconsistent, and often biased set of information about a customer.

The best way to personalize the conversation with the customer is to allow the in-person banker or (the digital online interface) to use technology to guide the conversation to discover the customer’s needs and circumstances, which can lead to very accurate recommendations and action steps. This allows the banker to focus on the human aspects of engaging with the customer.

Personalizing the entire experience by involving the customer builds trust and loyalty. When executed successfully, this technique is a true differentiator.

“Keep a real-time pulse on changing customer preferences through the use of conversation guides to ensure current needs are met and loyalty will build.”

George Noga, CEO, Ignite Sales, Inc.

Ignite Sales is here to help financial institutions provide powerful and experiential services on all channels for FI customers, members, and businesses. We welcome the opportunity to partner with your financial institution to create an experiential service that combines all of the elements needed for powerful engagement. Give us a call >