Banks and credit unions can attract the attention generation by offering personalized financial advice they are looking for.

Over the past decade, countless resources and marketing dollars have gone to courting one group: Millennials. It’s with good reason, as the world’s wealth transfers to this cohort over the next number of years. Now another generation has begun to reach an age where they’re opening accounts and building loyalty to a banking partner. Within the next 15 years, the Gen Z population will become the largest US age group ever, peaking at 78 million people.

This mean it is prime time for FI’s to step up to the plate and start building those financial relationships. According to the Consumer Banking Report by EPAM, 61% of Gen Z want financial advice from their bank. They’re not just looking online, but in branches as well. When asked if they would like their bank branch to provide them with financial education sessions, 40% of those under 24 responded positively, while 46% said they wanted to see advice drop-ins at their branch.

61% of Gen Z want their bank to give them advice on how to manage their money.

Targeting this generation will be like no other, since you’re competing against other brands, as well as their preferred social media influencers. Banks and credit unions have a unique opportunity to make sure that as Gen Z’s money knowledge shapes, they’re helping to guide them along. Gen Z’s willingness to trust influencers will also allow them to remain loyal to the one providing the best advice. Financial institutions have the opportunity to offer that influence.

Connect on the Platforms They Want

One unique aspect of Gen-Z is that they’re used to owning their own identity. They open social media accounts by the time they’re 13, connecting with friends, watching influencers and presenting to the world what they want. They have also often carried phones and connected with friends via text since they learned to type.

That’s why it’s also important to help guide them towards savings, checking and credit accounts by interacting and engaging on the platforms they prefer. Sure, this means having digital solutions to banking. But it also requires interacting with them on the right social channels.

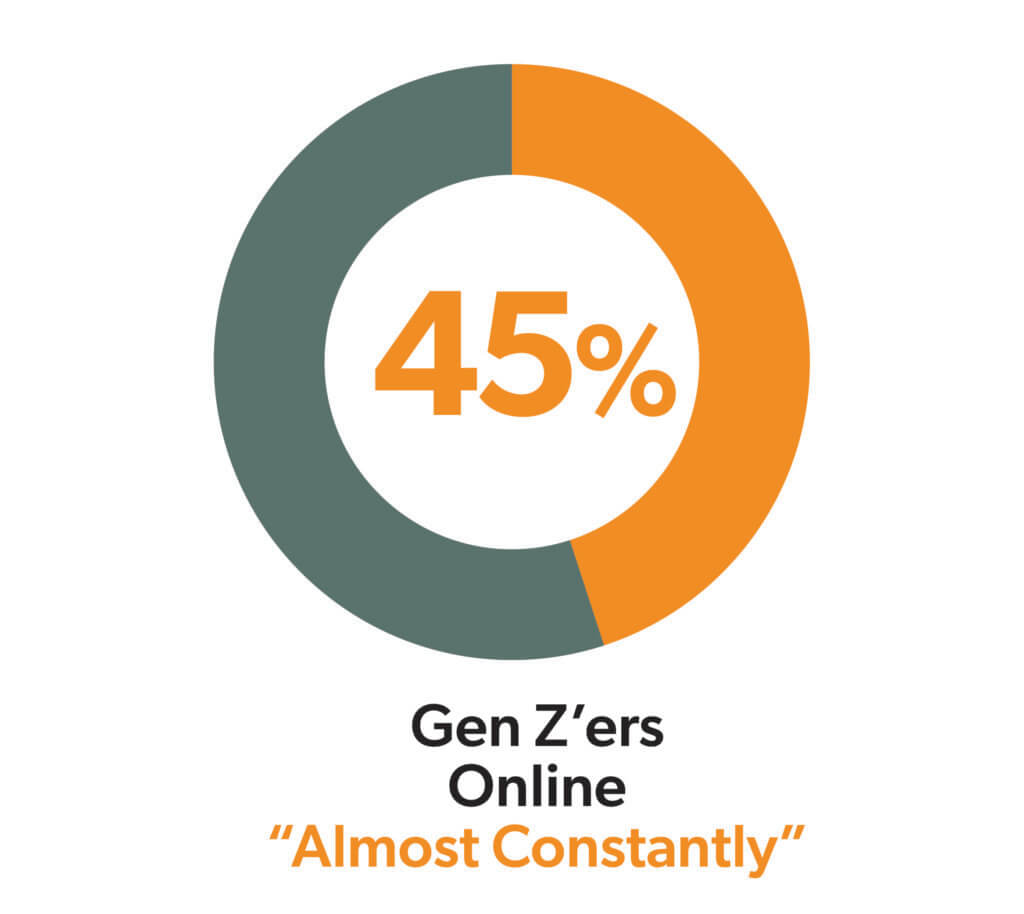

Pew Research found that among those 13-to-17 years old, YouTube, Instagram and Snapchat remain the most popular platforms. Nearly half (45%) of this age group is online “almost constantly.” Having a strategy to provide financial advice on these platforms and adapting the strategy as another platform rises to prominence – like TikTok – will be key to building familiarity and trust among this group. If they begin to see your brand on these platforms and trust the message you give, then it will carry over when they have more money to save.

Target the Advice

It’s important to remember, again, just how much financial uncertainty many in Gen Z have seen their parents go through. Between the 2008 Global Financial Crisis and the deep job losses in the COVID economy, Gen-Z has been an eyewitness to much of the financial hardship that other generations have endured. This has made them particularly concerned about financial matters.

They want to know how to secure their own funds. They’re also accustomed to searching for a specific problem they have and finding thousands of videos, no matter how obscure the topic. That means, they’re also used to catered advice. Still, in that advice, they don’t want to feel as if they’re being sold.

It’s a fine line to navigate, but having multiple ways to offer insight, expertise and advice on a variety of subjects, so they can easily discover the information when they want, will help you break through the constant barrage of noise and data that they’re inundated with.

Be Consistent

Gen Z grew up in a very politicized world, as the current 2020 election highlights. This makes them highly aware of social issues, by and large. They also hate inauthenticity. According to a survey of 500 13 to 24 year-olds, 67% of respondents agreed that someone authentic to their values is “cool.” At the same time, only 19% admired someone simply because of the size of their social followers.

This indicates that they want authenticity. Again, this goes back to influencers, where the user can have one-on-one communication with the person providing tips. They learn to trust that person. They believe that influencer is consistent with their advice and their strategies. Credit unions will need to provide the same consistent message, but then back it up with how they do business.

If they don’t, then Gen Z will leave. Like millennials, Gen Z will ditch a brand that no longer represents their core values.

Teach. Don’t Preach

The financial priorities of the cohort, according to a study by Charles Schwab, is building savings, managing a budget and putting together a financial plan, among others. At the same time, only 14% understood that it’s a good idea to have 6-12 months of emergency savings and 29% knew that closing a credit card can hurt their credit score, according to a survey by EverFi.

This group wants to understand money, but they don’t yet know how to grow their wealth. This provides a unique opportunity for credit unions willing to take the time to guide Gen Z in their effort. But if you come at it as a know-it-all, they will turn away. Instead, lend a helping hand, providing advice as they seek it.

If you do so, you could have a customer for life.

Ignite Sales is the leader in digital customer engagement, using artificial intelligence for engaging analytics to facilitate growth, deeper product penetration and increase satisfaction levels of bankers and customers.