As customers make plans for 2021, they’re seeking advice from you.

The finances of your customers have changed and for many this alteration may last forever. But these financial shifts likely look very different, depending on the customer.

On the one hand, you have customers saving more money than ever before. The personal savings rate in the US stands above 13%, which remains well beyond historical norms as people began to stash cash at the beginning of the pandemic and haven’t stopped. On the other hand, 64% of customers don’t have enough funds in short-term savings to cover one month’s expenses.

“Banks will need to get to know their customers (again)” in 2021. Those that take the time, care and effort to understand the needs of their customers will win.” – Forrester

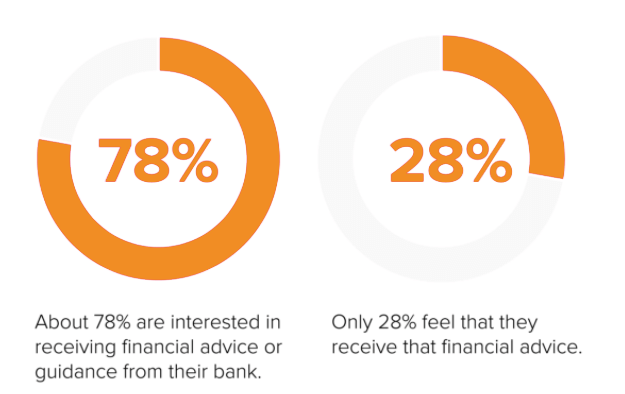

Whether your customers have increased savings or seek to stretch their finances through the other side of the pandemic, they’re turning to the bank for advice. It means, lending a helping hand has become table stakes in banking. We delved deeper into this dynamic in our new whitepaper, which provides an explanation of why banks must incorporate financial wellness into their customer service and how to do so safely, effectively and economically. While your customers expect this level of service, the strategy can also secure your future growth.

As you do, you will build hope and trust with your customers. It’s a process that plays out over time, just like financial wellness efforts. But as your customers’ finances improve, the bank will reap rewards as well by utilizing these tactics.

Share Your Resources

Customers naturally trust banks. It’s an extension of the fact they allow you to hold their life savings within your vaults. On a very basic level, they know your institution has securities in place that they can trust. Your institution also has thousands of others that have dealt with the financial issue that they currently face. Providing access to those stories, whether it’s through online material or another, more direct connection, gives your customers the hope that while they may struggle today, it won’t last forever.

Through this, you’re rewarding them for their trust, providing them with knowledge and insights that they wouldn’t otherwise have access to.

Giving them this chance to connect and learn from others opens the customers’ minds to ways in which they can solve their own specific problems. Your bank likely has the solutions to help.

Encourage Small Steps

With finances, the smallest step can lead to long-term rewards. Sometimes, when in the thick of financial planning or while seeking solutions to recover from a financial trouble, it’s difficult to see the impact of changes today. Customers want you to ease this monetary stress, but you can’t really do the work for them. Instead, it’s about showing them what can happen with small changes.

You don’t have to see the whole staircase, just take the first step. – Martin Luther King, Jr.

While the infamous quote from Martin Luther King, Jr. is not about finances, it is about taking positive steps to make changes. For financial institutions leading consumers to financial wellness, maybe it’s developing a calculator that provides the long-term growth of storing an emergency savings within a high-interest savings account or certificate of deposit. Or, instead, providing material around the various differences in refinancing a high interest mortgage. Your financial institution can determine the best steps to highlight by utilizing analytics on the services customers opt into, incorporating data to support what they need help with most.

These encouraging steps forward, can also benefit the bank. Since it’s in the best interest of the customer, both sides win by showing the long-term impact of smart financial decisions today.

Provide Both Tangible and Intangible Rewards

Controlling one’s finances comes with its own set of rewards. By finding ways to move forward on goals and reduce the concern of debt, customers’ stress levels will fall. This will move them towards thinking about the future more, looking for new ways to incorporate this new-found confidence in their finances.

Banks can help the process, with the right incentives. Maybe it’s working with partners to provide a discount when shopping, after people reach a certain level of savings. Or, instead, it could mean setting up experiences for customers once they have reached certain benchmarks.

These extra incentives work to ensure your customers realize the fruits of their gains. But it also helps endear them to your efforts in their financial wellness journey. Since that journey can take years, the bank’s touch-ins and incentives ensure you’re linked hand-to-hand in the process of their growth.

To see how to incorporate these financial wellness tactics into your current customer process, take advantage of a free download of our new white paper, Financial Wellness Just Became Table Stakes in Banking.

Ignite Sales is the leader in digital member engagement, using artificial intelligence for engaging analytics to facilitate growth, deeper product penetration and increase satisfaction levels of bankers and members.