Online Account Opening (OAO) has been increasingly important to banks as they transitioned to a more digital banking environment. Since Covid-19 has accelerated the move toward digital banking, effective OAO is now critical for a frictionless customer journey. However, there are challenges that prevent banks from achieving the optimal OAO performance, even using the best OAO applications available. Let’s look at some important background information and then discuss four of the main challenges for reaching the most effective OAO results.

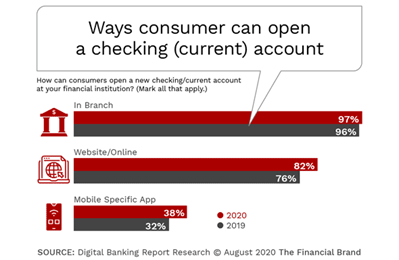

The percentage of financial institutions offering online (website) account opening reached a new all-time high in 2020 at 82% with mobile at 38%, according to the Digital Banking Report. That represents a significant jump from 76% online and 34% mobile in 2019 (and up from 66% online and 18% mobile in 2017).

Yet, many institutions who have purchased (expensive) OAO systems are finding challenges to successful online application completions. Customer expectations about how they interact with their bank or credit union, as well as their understanding of the process and what information is being required, leads to high drop off rates, and erosion of trust.

The online account application abandonment rate is at an all-time high of 97.5%.

In general, 60-80% of people drop out of an application process after starting a form. That indicates that many people are clicking on the “apply” button without having the right information to complete the process or are experiencing friction such as confidence in selection.

Even after customers start the application process, the abandonment rate remains high. As high as 97.5%, according to Peter Wannemacher, Senior Analyst at Forrester. This represents a vast wasted opportunity, especially given that these customers had enough interest to start the process in the first place.

Challenges of Online Account Opening

What are the most common reasons prospects are abandoning the online application process? Consider these four challenges to digital account opening.

1. Choice overload before getting to OAO

One of the top challenges for customers even starting an online application is feeling overwhelmed by product information and options. Banks and credit unions often provide their customers with well thought out product options designed to meet the needs of the many consumer segments within their customer base. This is good! However, it’s often difficult for consumers to make a decision with so much information and so many options, resulting in “choice overload”

Studies have found that “choice overload,” has a negative impact when it comes to making important decisions and can leave customers with feelings of anxiety and dissatisfaction. With no banker present to guide the consumer to the best choices and helping them apply on-line, drop-out rates increase and the volume of applications declines.

2. Unclear information

Similar to choice overload, not understanding the differences between various options, or not understanding exactly what it takes to qualify for each type of account, can lead to confusion and abandonment. Customers who don’t quite understand what they are applying for may lack commitment to finish the process.

If the process requires uploading documentation (such as proof of income) or having specific credit score, and this wasn’t clear from the start, the customer may leave the Online Account Process (OAP) without completion and feel frustrated or even misled by the online application process. This could translate into negative feelings toward the bank or credit union.

Studies show that customers (especially Millennials) have high expectations (set by companies such as Venmo, Amazon and Credit Karma) for how easy an online application process should be. If you’re not clear up front about what they are applying for and what the process is (and make it easy), they will drop out and leave with a less favorable opinion of your institution.

3. Friction in the process

Another reason for high abandonment rates and sub-optimal OAO performance is excessive friction in the process. Friction can take many forms:

- Redundant entry of required information into the OAO application.

- Single thread OAO process that does not allow for more than one account to be opened at time.

- Required information that is not automatically or readily available for selection or auto loaded into the OAO application

Of those who do complete the application, over 50% are likely to be declined the account because they do not qualify. (As many as 90% of people don’t read the fine print.) But being declined leads to bad feelings toward the bank.

Removing friction from the customer journey was a top concern of the 2021 Digital Banking Report, with more than 61% of respondents citing it as a priority.

4. Fear

If customers are uncertain about the process, a number of fears can affect whether they complete the online application. These can include:

- Fear they won’t be approved

- Fear of wasting time (if rejected)

- Fear of giving out personal info

- Fear the process isn’t safe

- Fear of opening the wrong account

That means the more you can do upfront to ensure customers they: a) have selected the right product, b) meet the criteria for the product, c) are using a secure system, and d) the process will not be too long or redundant, then the more likely they will be to successfully complete the application.

Make the Most of Your OAO Investment

Creating a positive online account opening experience is not something that banks and credit unions can ignore. In fact, according to the American Banker podcast, institutions that rely heavily on digital account opening experienced a 16% growth in 2020, while these that were non-digital saw a 9% decline in growth. Furthermore, the median acquisition cost for a non-digital customer is about twice that of a digital customer.

The median acquisition cost for acquiring a non-digital customer is $138 per account, but the median cost for acquiring a digital customer is only $77 per account.

Is your bank or credit union doing all it can to improve your online account opening experience?