For banking customers, financial decisions are not routine transactions – they are often life-impacting choices riddled with uncertainty. Making the wrong choice can create stress, generate unexpected fees and lead to annoyance or dissatisfaction. If you’re presenting all of your product options at once like a deli menu and treating banking interactions like purchases, you’re missing out on key opportunities to connect with your customers on a deeper level and instill loyalty.

It’s time to shift your focus from completing transactions to having conversations. Real conversations. Conversations that let you engage with your customers, interact with them on a more personal level and provide opportunities for them to share important information that will guide them to make better decisions. From understanding their long-term goals to knowing how much their monthly income fluctuates, seeing your customers as people first is the key to helping them find the right fit when choosing banking products and services.

Conversations play a crucial role in getting customers on the path to engagement.

Business owners, especially small business owners and startups, may have made a significant emotional investment, along with pouring time and money into their venture, and they need banking and financial services that respect their sweat equity. Consumers, on the other hand, may have retirement or savings goals that impact their choices. Beyond your services, what you can offer is expertise and insight into how the right banking options can improve their success. That starts with a conversation.

Engagement and loyalty start with conversations

Starting conversations that can lead to better customer engagement means asking questions. Asking the right type of questions can help your customers and prospective customers narrow down a broad range of potential options to the right choice.

Start by framing the discussion to make it about more than just selecting a product. Encourage everyone in your branch, from tellers to platform associates, to set the tone every time they speak with a customer. Demonstrate that you have valuable knowledge to offer and are acting in the customer’s best interests by looking out for their financial well-being.

Take it to the next level by asking questions that help you get a better understanding of your customer’s needs and goals. Don’t overlook how the customer’s financial requirements may change over time. Instead, set the stage for a financial future that helps your customers reach their potential.

After asking the right questions and narrowing down options, be sure to focus more on benefits than on product features and relate these benefits to your customers in a personal way. Meaningful relationships are born from engaging conversations and personal connections.

According to Gallup research, customers become more engaged when their banks have these types of conversations with them. In fact, 66% of “engaged” customers say their banks are “partners with me in managing my finances” and that their bank “takes the lead in helping me get where I want to be.” Less than 1% of “disengaged” customers feel this way about their banks.

Another study of customer loyalty in retail banking in Spain showed a strong relationship between customer engagement and customer loyalty. Satisfaction with the customer experience was, of course, a top feature, but self-brand connection through emotions was also shown to have a significant influence on customer engagement.

How to have effective conversations

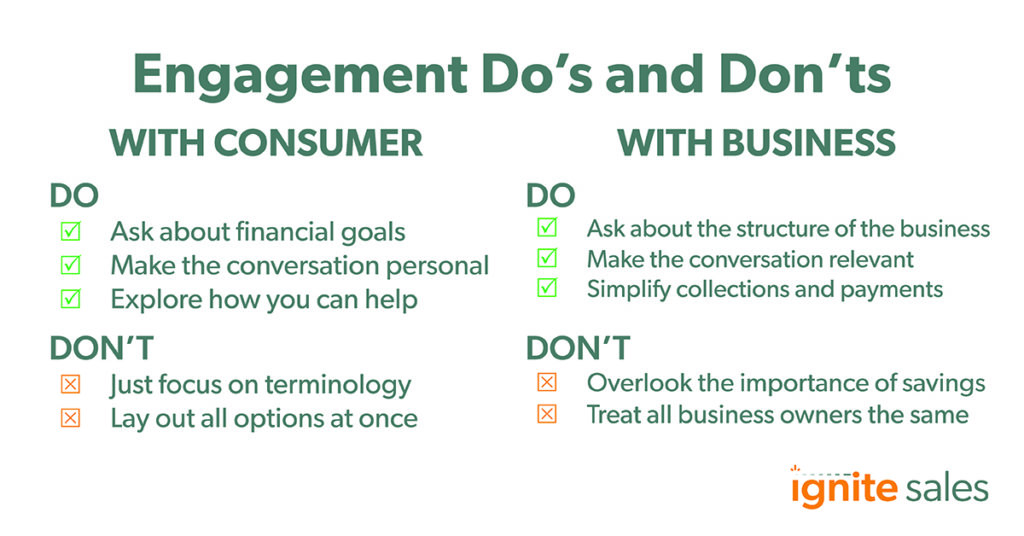

Whether you’re working with consumers or businesses, it’s important to start conversations that help you deliver more than just transactions. Here are some do’s and don’ts.

WITH CONSUMERS

Do:

- Ask your customers about their financial goals. Make sure they know that helping them meet their financial goals is your top priority and that you’re not just selling them a product.

- Have a discussion about savings and building a nest egg. Ensure sure their plans align with their goals. Help them understand the options and how to get started.

- Explore how you can help your customers build financial wellness.

Don’t:

- Don’t just focus on rates, terms or conditions

- Don’t lay out all the options at once

WITH BUSINESSES

Do:

- Ask questions that help you understand the structure of the business. Is it a single proprietorship or corporation? Do they have partners, a board or others influencing financial decisions? Are they a retail, ecommerce or service-based business?

- Find out what their cash management systems look like. Are they cash-based or credit-card focused? How often do they collect payments? How often do they make deposits or withdrawals? Ask questions to align with your options.

- Determine if they work with vendors. Will they be making a lot of payments or mainly collecting income? What bills will be automated?

Don’t:

- Don’t let business owners overlook the importance of savings.

- Don’t treat all business owners the same.

Focus on simplifying the options

A 2018 financial customer survey by Accenture showed that 47% of current account holders rank whether they believe an institution puts customer’s interests first as one of the top three criteria when selecting a bank or credit union. And the same survey found that the most common reason customers leave their bank or credit union was “lack of personalized services.” Demonstrating that you put your customer’s needs first by helping them make the right financial choices for their needs is critical to both engagement and loyalty.

Help to simplify complex financial decision making for your customers by guiding them in a personalized way toward the right products and services for their situations. Use every opportunity you have to start meaningful conversations that build engagement and loyalty.

Guides to Better Conversations

Uncovering and aiding in the customer’s financial wellness can build healthy profits for the bank, now more than ever. Get our free guide to starting conversations about financial wellness.