Prior to the pandemic, the future of banking seemed clear. Digital would eventually lead the way, but for traditional banking many customers continued to prefer the branch experience. Whatever changes banks could expect in the future, it required a slow, methodical approach to appease every customer’s preferred method.

The pandemic changed that notion of when the digital revolution would take hold. Nearly, overnight, banking had to react to trends that were expected to play out over the next decade in order to cater to lockdown orders and social distancing. Now, as the potential for an end to the pandemic nears, it’s important to wonder what tactics, practices and offerings will stick and what will revert back to once was?

Your Customers Have Grown Comfortable Online

In the pre-pandemic world, banks could methodically move towards digital offerings because older customers simply preferred the face-to-face experience. Nearly two-thirds of those over 50 were hesitant to use a smartphone for financial tasks, according to a 2019 survey. By April 2020, in a survey of those over 60 found that 77% had conducted a financial transaction online.

Even in a post-pandemic world, the transition to online banking has occurred. It’s important to not only offer tools to allow customers to conduct their banking online, but also to ensure your agents connect with them on a regular basis to understand their needs and provide them with solutions.

Customers Are Returning to Branches

While it’s easy to assume that customers that now do a little more banking online will continue to do so forever, there’s actually greater chance that people return to banking as they did prior to the pandemic, at least in some ways. In many cases, customers want to talk to an agent and see a face. At the height of the pandemic, new account openings in a branch fell precipitously. By June 2020, new account openings in-branch reached 90% of the level seen the year prior. According to Ignite analytics, actions conducted in-branch in June were 16% higher than those that occurred in February, just before the shelter-in-place orders went into effect.

As more customers decide to bank in a branch – and they will – it’s important that your agents lead them to the right help. Using precise, guided conversations that seamlessly infuse into your sales process, your agents can provide the customers help while offering them the service that best fits their needs, based on both their online and in-person activity. Having that blend, will ensure the experience remains valuable, no matter how your customers choose to bank, post-pandemic.

The Cash Demise Heightens

The rate of cash use has been falling for year pre-pandemic and it’s a trend that the past year has heightened. EY found that 20% of customers expect to use less cash and more contactless payments over the next couple of years, and that’s after a fall of 57% in cash use among the same respondents in a survey.

Incorporating other products by using analytics that highlight your best performing services that provide incentives beyond ATMs and other cash-based perks will help you adapt to the new normal that will likely continue, especially as contactless payment systems proliferate.

Your Growing Trust

In the crisis, banks were seen as an institution of support as people faced significant financial hurdles. At the same time, if a bank appeared to take advantage of the financial hardships across the country, customers could turn on the institution. Nearly half (44%) of customers said if they saw a bank do so, it would negatively impact their purchasing decisions, according to the EY survey. The good news? They trust you now more than ever.

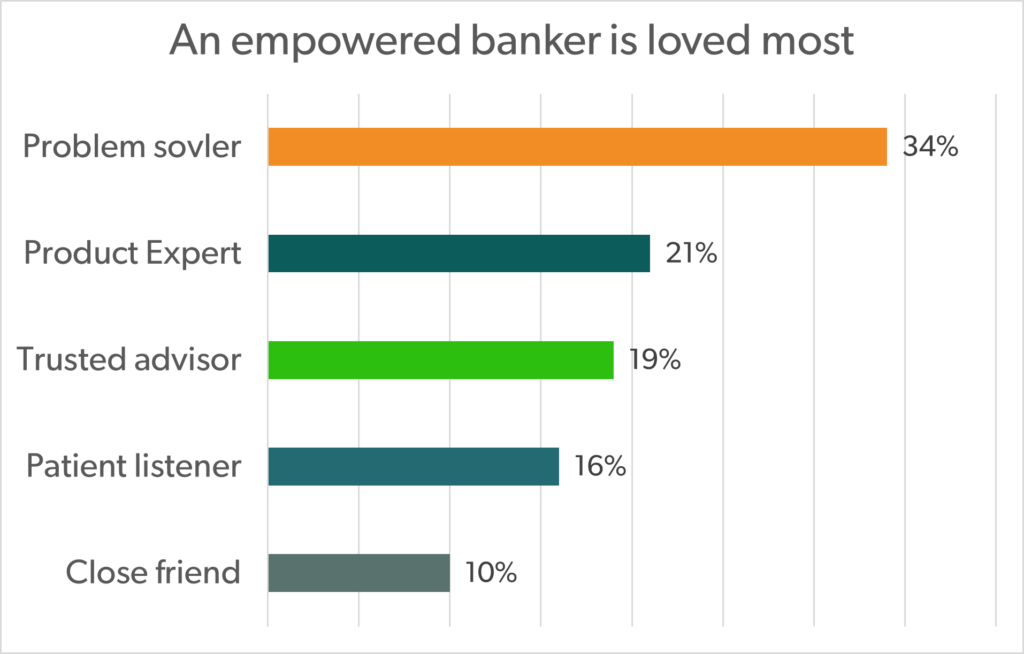

According to the Gladly 2020 Customer Expectations Report, more consumers want their banker or customer service representative to be empowered problem solvers, have product expertise, be trustworthy and a good listener.

With this, you have the opportunity to provide guided advice since you have your customers’ ears. Offering the right types of tools for a small business customer will go a long way, even post-pandemic since it may take businesses some time to return to their pre-pandemic levels of success. Consumers on the other hand, want an empathetic ear as well as a problem-solving advisor.

Whatever the individual case, you have to make sure it’s advice that improves their financial wellness. If you do, then you will have taken a big stride to ensure the customer remains once the pandemic ends.

Ignite Sales is the leader in digital member engagement, using artificial intelligence for engaging analytics to facilitate growth, deeper product penetration and increase satisfaction levels of bankers and members.