Helping credit union members with the shift to digital

Engaging with your members online now can turn them into digital bankers for life.

With COVID-19 continuing to wreak havoc on the US, credit unions and members have had to adapt to a primarily digital world. But it has also created a conundrum: How do you engage with members if you can’t see them in-person?

Prior to the pandemic, 53% of the banking public interacted with their financial institution via digital tools at least once a month, according to McKinsey. And only 33% of members interacted with the bank digitally more than once per week. This leaves a large chunk of the member base just now adapting to the digital banking experience for the first time. With COVID still months away from regressing, banks can use this moment to teach members how to fully engage, digitally.

Those unused to the digital banking space need help. It’s not simply clicking off the lights at the brick-and-mortar location and leaving member service up to AI or automation. Instead, it requires the right strategy, approach and dedication to ensure your members feel comfortable interacting online, giving them information that they need to bank and provide them with engagement to keep them returning.

The opportunity is vast. According to PwC, a digitally engaged member spends more on credit cards and other services than those that don’t. Moving more members to the online space will benefit you, with the right plan.

Draw Them In

Connecting with a member digitally means you have the opportunity to meet them anywhere. The downside? You’re competing against far more voices for their attention, whether you’re speaking via social, email or through advertising.

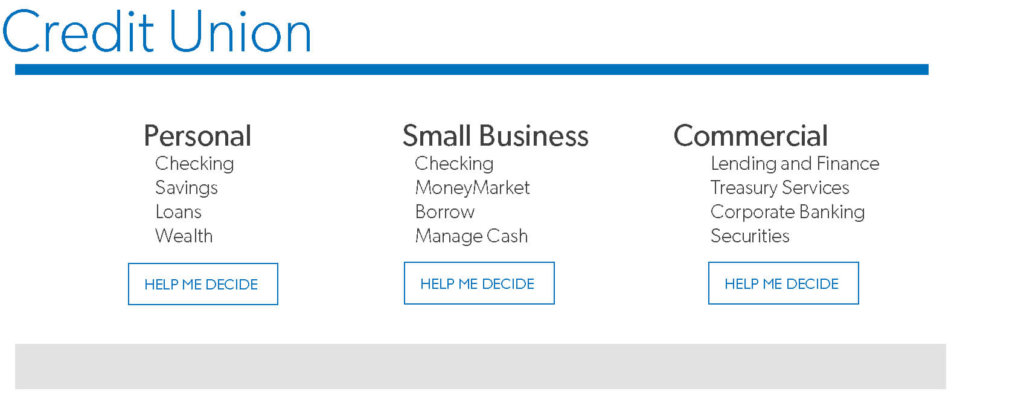

Instead, you need to find a way to draw them in. To do so, offer them targeted tools or information, based on their individual financial situation. For some members, they’re currently dealing with the financial hardships from COVID, whether they’re an individual or a small business. Using proper member data, you can determine which members may need more guided advice. You can then provide them with that type of information. These can range from videos your advisers provide, offering tips on how to manage finances during a job loss. Or it can be a guide on how to properly manage business debt.

For others, they’re doing well. Having a tutorial on, say, upgrading to a second home, would connect with those that may consider such a move.

Tailor your tools for each individual person based on their own financial wellness. It will help better catch their attention and view your institution as a guide in their recovery.

Allow Them To Reach You Quickly

The tools that banks have to connect with members to answer one-off questions have grown in their complexity over the past decade. It’s no longer just a frequently asked question section, but also, in many cases, a virtual assistant answering basic queries. These are important to have in place and about 60% of banks have implemented some form of AI, with 32% using a virtual assistant.

But the member’s journey doesn’t end the moment they have their question answered. It’s on banks to seek insight into how the member solved their issue, what might follow once someone clears a specific hurdle or where someone should look next. Providing ways to build in touchpoints, either through direct marketing or by having a representative connect with the member, builds trust with the user. They’re now viewing your bank as a resource for more than just the one financial issue, but any financial concern.

Creating that active engagement is key to building loyalty that no longer exists in the banking member.

Understand Who They Are

Someone that reaches out to their financial institution following a job loss can look very different, depending on their current stage within their financial wellness journey. A person that just got downsized from their first ever job may need to understand the resources available to pay back their credit card bill. Another person in their 60s may use a severance to retire.

As a bank, you wouldn’t want to provide similar information to both people when they connect with you. When someone walks through a door, you might have some inkling of insight on what they need, based on how they look. That’s not the case when they reach out online. But your agents should still understand exactly where the member is in his or her life, so you can provide them with the information and tools that work best, today and moving forward. Start with an intelligent, guided and digital conversation to understand and uncover where your members are today and where they want to be tomorrow.

Look To The Future: Financial Wellness

By most accounts, it could take years for the economy to fully recover from the health crisis. With small businesses trying to survive and individuals protecting their resources, both groups face many hurdles ahead. By providing financial wellness and guidance, banks can ensure they’re the calm, caring and guiding voice.

Using your data, you can tailor future advice and tools based on the current issue a member faces. Providing helpful hand in pushing members to look to the next stage to protecting their financial wellness can ensure they’re looking forward instead of treading water, after solving an initial issue. Offering that insight in your communications will lead them to you, once they’re ready to commit to a strategy.

After all, the crisis will end. How you continue to engage with members now, while they’re online, will determine if they continue to bank with you digitally for the years to come.

Ignite Sales is the leader in digital member engagement, using artificial intelligence for engaging analytics to facilitate growth, deeper product penetration and increase satisfaction levels of bankers and members.