Is it really true that the customer always comes first? Or, in banking, is that just a tired cliché that’s stamped on banking strategy where the number one goal is profitable growth? Are bankers ready to take the leap of faith that always serving the best interests of consumers and small businesses will actually be the straightest path to sustainable, profitable growth? McKinsey found that banks with the highest ratings of customer satisfaction had 84% faster growth in deposits, when compared to all other banks.

When it comes to building a strong, profitable bank, the focus has always been increasing deposits and building a robust set of products. Rightly so, of course. It’s the nuts-and-bolts of banking. But where and when does the customer and their needs come into play?

While the bottom-line figures receive a lot of attention, creating the right type of customer relationship can produce both from a growth and loyalty perspective.

As a unique side effect of the fintech boom, banks must find ways to connect with customers and build a relationship that can grow now more than ever before. Building this customer engagement and relationship isn’t simply a soft part of marketing. It’s a core attribute to growing profits.

It’s not always easy to see a straight line to your efforts in courting, learning about and remaining with a customer through thick-and-thin. Yet, there are many ways this tactic of engagement will improve the bottom line and build loyalty.

Loyalty Isn’t Lost

Customers’ ability to take care of many of their financial needs from home has become an important side-effect in the transition to digital banking. They rely less and less on going in-store to talk to a bank representative. The lack of interaction leads to a decline in customer attrition. Nearly 80% of customers visit a branch less than once a month, while 57% view their bank experience as simply “transaction centric.” Meanwhile, Bain & Co. found that many customers continue to hold a bank account at their primary bank, but then open separate accounts at other fintech firms. This hidden loss doesn’t show up in the end of year figures but can dramatically reduce performance and sustainability.

What’s the difference between those customers that stay and those that go or “cheat” on their primary bank by opening an account elsewhere? It’s the level of relationship. Being the first to ask your customers about their financial goals, understanding their needs then providing solutions prevents them from looking elsewhere. Having strong interactions with a customer not only allows you to hold onto their business, but they will spend more in ways that circle back to you.

Of those banking customers in the US that are promoters – or fans – of their bank, they spend nearly $2,000 more a year in credit card purchases than those that are bank detractors.

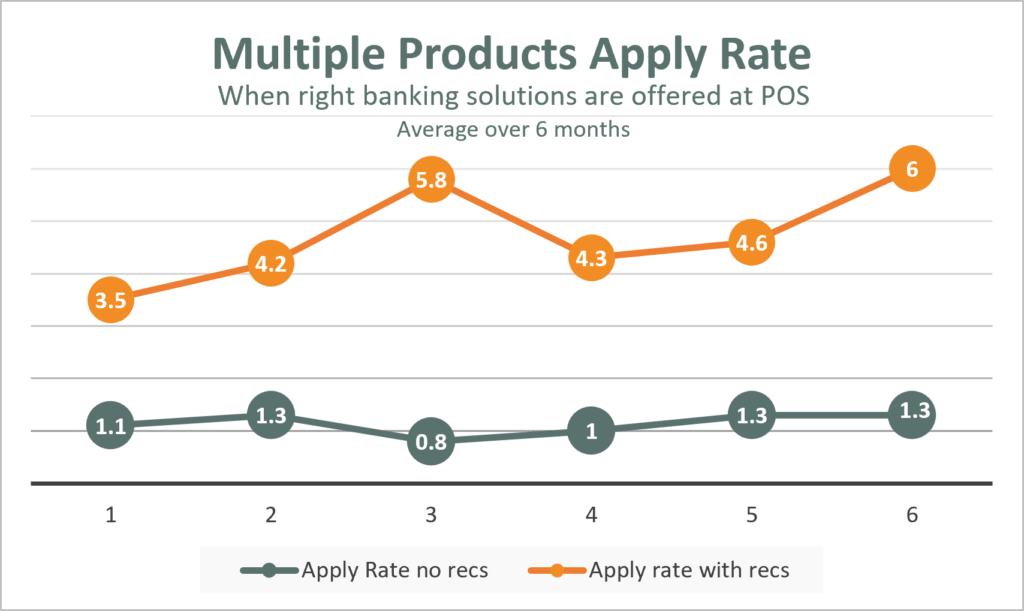

One Customer, Multiple Products

As the popularity of fintech tools have grown, so have retail banking’s response. From building online offerings, incorporating mobile access and connecting third-party fintech tools, retail banks have tried to address the issue of startups in the space. If your customers aren’t aware that you have these offerings, then they will switch in an instant.

That’s where this customer relationship and development can ensure they stay within the fold, especially as you build more offerings. By simply connecting with a customer, based on where they currently reside in their financial wellness journey, you can provide them with the information and fintech tools that you have in place. You can seamlessly ensure you offer customers the right solution and products based on their needs. This helps the customer bank smarter. It also allows them to bank smarter at your bank.

Customers don’t want to have multiple banking relationships or walletshares. The reason they do? You’re not connecting with them, as they seek out information. This leads them to a fintech instead.

When The Economy Turns Sour, They Stay

As the old saying goes, don’t waste a good crisis. For banks, the response to COVID-19 has separated those institutions that understand their customers from those that don’t. But for the customer, they’re looking at banks for help. Those banks that have understood the need of customers, provided them with resources to circumvent the challenges of the pandemic and offered tools to overcome it have reported higher levels of retention and conversion, according to Deloitte.

Recognition Is Everything

Part of the reason that an engaged customer is more loyal, willing to try more products and trust you is because the customer also understands how you’ve helped them. You’ve had conversations with them. You’ve had agents check in on their progress. You’ve provided them with tools to think about, for when they’re ready to take the next financial steps. Maybe you’ve even developed seminars so they can learn strategies that might help them down the line.

“Ignite’s solutions were made with the bank’s sales team in mind and truly provide that extra element to drive meaningful conversations. Central Bank has enjoyed partnering with Ignite to achieve more focused conversations to help customers reach the endgame faster.”

—Dan Westhues, Executive Vice President and Chief Marketing Officer of Central Bank

Such a customer doesn’t suddenly forget this attention. They begin to recognize your agents as people. And when they know there’s someone at the bank that they can talk to about their next home loan or when they decide to launch a small business, then they turn to that person for help. They recognize, after all, that they’ve built a relationship.

It’s not a one-side relationship, though. Instead, what’s good for the customer is good for the bank!

Ignite Sales is the leader in digital customer engagement, using artificial intelligence for engaging analytics to facilitate growth, deeper product penetration and increase satisfaction levels of bankers and customers.