Part 2: Digital Technology Improves Employee Recruitment, Onboarding, Training and Retention

In the second article of this two-part blog, we discuss how customer engagement innovation, such as digital conversation guides, can help banks and credit unions address the current employment shortage, while also improving employee and customer satisfaction. Part one took a closer look at what created this situation and how financial institutions are responding.

While the world recalibrates to a new normal after the pandemic, some aspects of daily life continue to be impacted. Employment is one area that took a crippling hit from day one. With fewer job candidates, remote work settings and new processes for socially distanced transactions, employers continue to face unprecedented challenges. While customers are critical to any business, success requires a solid team of knowledgeable employees.

To make matters worse, financial services workers in particular face additional obstacles. They are concerned about the push toward automation within their industry, which some fear could leave them without jobs. According to a survey by meQuilibrium, a digital resilience-coaching platform, financial services workers reported the second-highest level of job stress and sleep disorders (behind tech industry workers). All that stress and anxiety can take a big tool on existing staff, both at work and at home.

The news isn’t all bad though. Technology and innovation can help you support employees, while also improving the customer experience and operational efficiency. Here are some tips to help your branch recruit, onboard, train and retain employees.

Only 20% of employers had at least 60% of their employees working from home at least once a week before the pandemic. Now, 69% expect at least 60% of their workforce to telecommute at least once a week.

—- PwC’s Remove Work Survey, June 2020

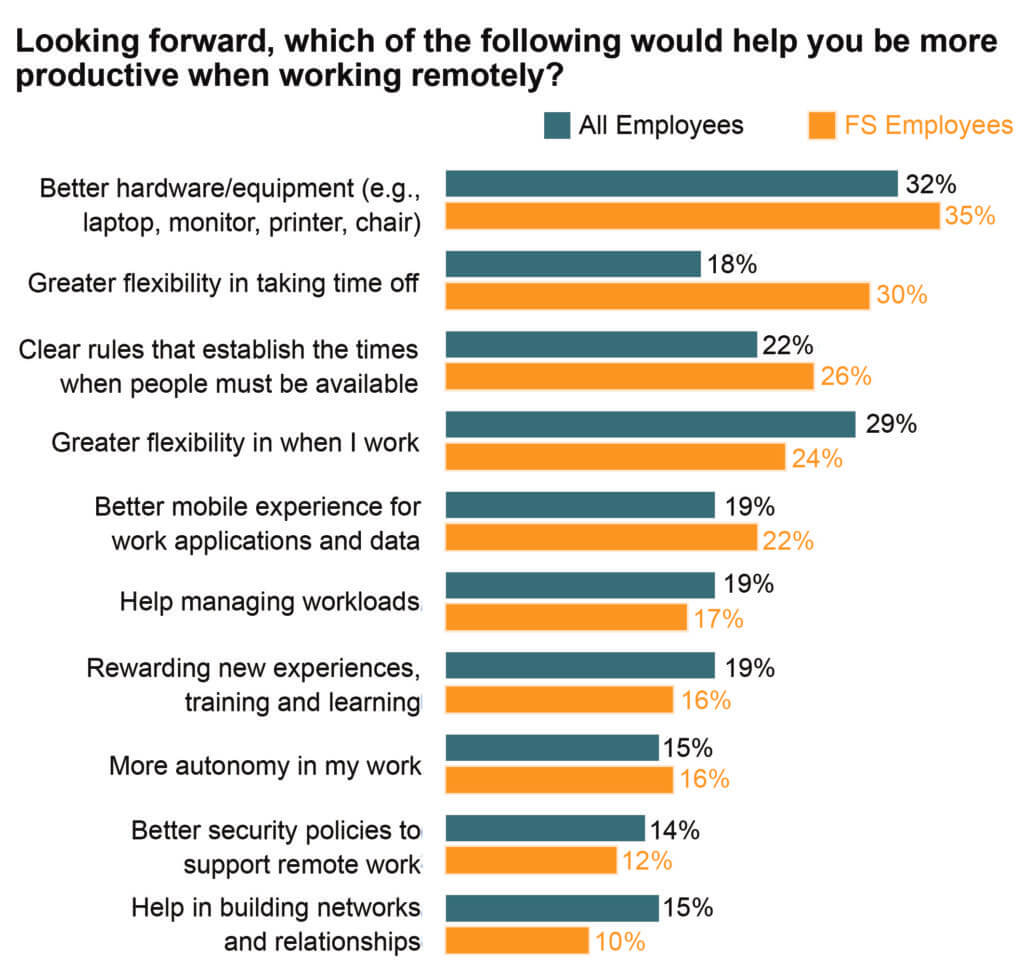

Tip 1: Offer Flexibility

Working remotely was once considered a perk for tenured, trusted employees. Now it’s a new way of life for many people and not always viewed as a benefit. Be sure to take into account what work-from-home means for each individual and provide the appropriate resources needed like hardware, technology and apps. You may find you have more productive employees as a result.

Up to 70% of employees say they are more likely to stay with an employer or start a job with an employer who offers educational benefits.

Tip 2: Promote Digital Learning

Employees in financial services are no strangers to technology. Even before the pandemic, the industry was moving toward digital transformation, which was accelerated out of need and demand over the last year. However, finance industry workers are experiencing greater “skills instability” as a result and require continuous learning to keep up in this fast-paced digital world. Unfortunately, insecurity breeds low morale. Instead use tools like guided conversations to deliver product education from day one, boosting confidence and improving job satisfaction.

Even if a new employee hasn’t yet learned the ins and outs of all the bank’s product offerings, they are able to work with customers and make appropriate recommendations based on guidance provided by the tool. With guided conversations, employees have all the correct information about product eligibility and rules at their fingertips, which keeps conversations and recommendations compliant.

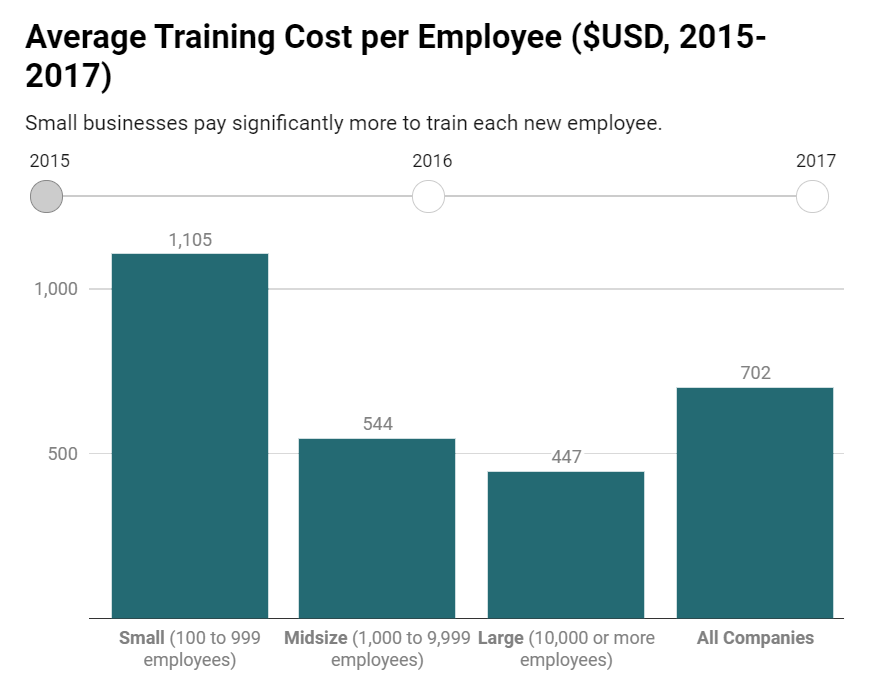

Small companies spent, on average, more than $1,500 on training, per employee, in 2019.

Tip 3: Focus on Training

The true cost of hiring an employee goes far beyond the person’s annual salary. It also includes recruiting, training, benefits and more. Keep in mind that it can take six months or longer before a company breaks even on the investment in a new hire. Proper training is a critical component of ensuring success and maximizing the effort that went into bringing a new employee on board. Digital conversation guides utilize technology to deliver cost-efficient training by offering product recommendations for customers while ensuring employee compliance.

Additional Benefits of Digital Tools

Employees and customers aren’t the only ones who benefit from digital tools like guided conversation guides. Managers receive data on metrics like close rates via a compliance dashboard. These essential analytics provide insights on the big picture, including which products are popular and which ones aren’t. By monitoring performance, management can make decisions about promoting certain products and sunsetting others. Managers can also see statistics about employee success rates with new account openings and cross-selling efforts.

“Digital guides allowed a new employee to succeed day one. This is huge for maintaining retention and reducing training costs.”

—Large Midwest Financial Institution

Contact us today to learn how customer engagement innovation can help you improve employee engagement and survive the staffing shortage. Or download our case studies eBook to discover the success other banks have had with this technology.

Ignite Sales is the leader in digital customer engagement, using artificial intelligence for engaging analytics to facilitate growth, deeper product penetration and increase satisfaction levels of bankers and customers.