Bankers Must Meet Customers Wherever They May Be

The pandemic has forever changed how work gets done. Social distancing mandates forced jobs that never had a work-from-home component into that mode. Pre-COVID-19, the financial service industry as a whole had not yet embraced a remote work philosophy. But that has all changed since the pandemic hit and bank branches around the country closed their doors.

Remote Work Here to Stay

While businesses have opened up, the remote work way of life persists. Companies and employees have found that working from home works better than expected. And workers today are requiring that option. A recent CNBC article reported that HR experts assert that today, if you’re not offering a flexible or remote program, you’re missing out on 50% to 70% of candidates. Furthermore, according to a study from Growmotely of working professionals and entrepreneurs of the future of work, 97% of employees don’t want to return to the office full-time, and 61% prefer a fully remote envhttps://www.growmotely.com/future-of-work#downloadironment.

Tight Labor Market

The country’s labor force is down five million people from pre-pandemic, and we are experiencing the Great Resignation, where record numbers of people voluntarily leave their jobs. As a result, banks and credit unions are struggling to hire and retain employees. Therefore, implementing measures to attract and keep staff is critical.

Financial institutions now need technology to allow staff to work remotely due to the tight labor market, quarantine, COVID fears, or childcare issues. Banks must quickly pivot to a digital-first model for sales and service.

Sinking Customer Service

Financial Brand recently reported that research from Rivel Banking uncovered that the percentage of households who say their primary banking institution is just not responsive has gone up by 212% during the pandemic. And that the percentage of households who say their banking institution does not understand their needs has shot up by 333%. To improve customer service, banks and credit unions must have a way to engage deeply with customers, develop a relationship, and enroll customers or prospects in new products without face-to-face contact at branches.

Remote Banker Technology

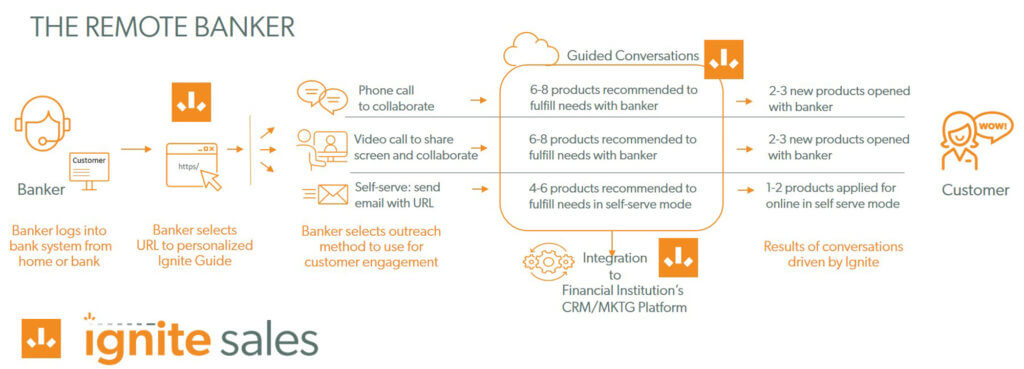

Remote Banker, a remote version of Ignites award winning Customer Engagement Platform, allows bankers to stay connected with their customers no matter where they are working. The Remote Banker enables bankers to engage with customers digitally using customized, dynamic conversation guides that discover customer financial needs and generate highly accurate account recommendations.

Remote Banker provides conversation guides to help bankers show interest in customers and the current unique financial situation with compassion and empathy through email and phone. The on-target conversations enable bankers to understand customer needs and recommend best-fit financial solutions accurately in real-time. The result is improved banker productivity from anywhere, increased brand loyalty, and successful account openings.

Remote Banker has helped bankers re-engage with customers who are not yet comfortable visiting branches again for financial guidance and tailored product selections and gives bankers the tools to get to the heart of customers’ current needs.

Remote Banker uniquely allows bankers to engage customers in digital sales and marketing conversations. The solution’s decision tree science and operational AI drive customer conversations and product selections relevant to each customer, whether consumer or business and their unique financial situation. Information is synthesized in real-time from a variety of sources to provide product recommendations and analytics data.

Conversational Data Helps Nurture Sales & Marketing Campaigns

Remote Banker captures all conversations digitally and shares this data with sales and marketing enabling bankers to hone marketing messages, campaigns, and spending. For example, suppose a banker recommended four products to a customer. However, the customer was interested in moving forward with all but one of the products, say a home equity line of credit (HELC). In that case, data on the HELC opportunity flows into the banks’ marketing system to ensure highly targeted marketing follow-up.

In addition, the Ignite analytics platform delivers decision-making data to bank management on sales and marketing operations to improve product offerings, processes, and marketing efforts. Ignite’s solution analyzes all data gathered during these customer conversations and gives decision-makers insights into customer trends.

“We implemented Remote Banker to allow our bankers to assist our customers during quarantine as well as into the future of all things digital.”

—Large Financial Institution in the Midwest

Banks and credit unions need to adopt a hybrid model of work to ensure hiring and retaining talent. Part of that adoption will include having the technology available to allow staff to work wherever they are to ensure consistency and productivity.

Learn more about how financial institutions can meet customers remotely wherever the banker or customer may be. Ignite’s Remote Banker won the Sammy award for sales and marketing technology in 2021. To put the remote banker to work for you click to schedule a guided demonstration.

Ignite Sales is the leader in digital customer engagement, using artificial intelligence for engaging analytics to facilitate growth, deepen product penetration and increase satisfaction levels of bankers and customers.