Amid staffing shortages and competition from disruptive online banking alternatives, today’s traditional banks and credits unions are facing challenges from all directions. To stay competitive and relevant in this continuously changing environment, you need to use any advantages you already have to your full benefit.

And what is one of the most important assets your bank has? Your team. Providing the type of customer service that sets your institution apart can be a critical differentiator for your institution. That means giving your bankers the tools they need to become Power Bankers.

Online banks offer a certain convenience and have potential infrastructure cost advantages, but studies show that what customers really want is great service. They want a banker who knows them and can help them achieve their financial goals, avoid unnecessary fees or fines, and creative a business or lifestyle that promises them a bright future.

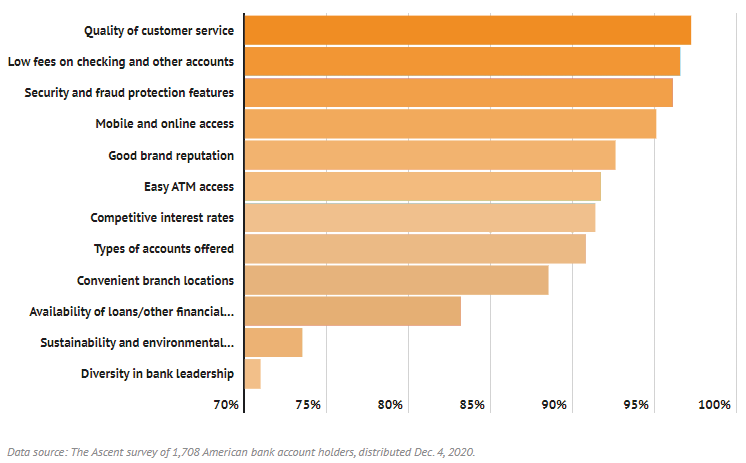

An 2020 Ascent survey for the Motley Fool polled 1,700 Americans and found that the number one thing customers want from their banks is quality of customer service. It’s more important than low checking account fees or security and fraud protection.

That’s right, your banking customers want you to deliver on the promise of being good at your job. They want bankers to be the experts and reassure them about the trust they place in your financial institution to keep their money safe, grow it and be available when they need it.

Number one thing people want from their bank

Empower Your Bankers

By bestowing your bankers with the right tools, you turn your associates or client service representatives into Power Bankers. Bankers are the face of your business to the customer: they must offer the right advice, recommend appropriate solutions and provide the best possible service to the client.

Banking customers are looking for a personal touch and individualized service that goes beyond transactions. In addition to helping customers with everyday banking activities like payments, deposits and withdrawals, they are looking for expertise and guidance from your banking team.

Make sure your bankers are prepared to answer general banking questions in the most helpful way possible and steer each customer toward the right solution for them. It goes behind just helping clients in a cheerful, positive way, to exhibiting in-depth knowledge that helps the customer solve banking issues and find the right solutions.

To grow your bank and build customer loyalty, a few essentials are needed:

- Your bankers need the skills (and frame of mind) to build customer relationships that focus on driving value (with a knowledge of products that help deliver bank growth and support customer goals).

- Your sales teams must be able to uncover and support customer needs (by discovering long-term goals and recognizing cross-sell opportunities).

- Your managers need tools to mentor and coach their teams to achieve success (and tools that help ensure compliance and monitor it).

Why Does Banker Knowledge Matter?

Customers tend to want to stay with their current bank. By creating a positive experience every time they come into the branch (or visit your website), you help build loyalty to your bank.

- Over 48% of consumers are unlikely switch to a new bank, even if it was a better fit.

- Almost 23% of consumers said they wouldn’t open an account at an online-only bank.

(The Ascent Survey, Dec. 4, 2022)

A clear way to build trust and loyalty is for your bankers and sales teams to be able to offer good advice about the accounts and services that best meet your customer’s needs.

- Power Bankers should be knowledgeable about all of your products and be able to express what makes one a better fit over another for a particular customer.

- Power Bankers should be able to advise customers about just-right products based on their long-term goals.

- Power Bankers should be able to recognize which additional banking products may help solve more of the customer’s long-term financial needs.

Give Bankers the Right Tools

Turning your bankers into Power Bankers means ensuring they have access to the right tools to provide excellent customer service based on accurate knowledge. Digital conversation guides are one tool that helps deliver on that promise. By asking relevant questions and leading customers through an interactive conversation, your bankers are able to advise customers about the most appropriate banking solutions for their situation – and get it right every time.

Bring New Hires Up to Speed Fast

The challenges of hiring in the post-pandemic world haven’t been exaggerated. If your bank is struggling with staffing shortages, or having to bring new hires onboard quickly, getting them up to speed is easier with tools that provide training and knowledge, and offset any shortfalls.

Digital conversation tools can help bridge any gaps in knowledge and turn your newest employees into power bankers from their first day on the floor. Your newest bankers can access all the relevant information about the customer from profiles completed online as well as from past in-person interactions, which helps ensure the employee’s interaction with the customer is helpful, relevant and compliant. The new hire will have confidence knowing they are answering the customer’s questions correctly and advising them in the right way.

Support Banking Compliance

With guided conversations, employees have all the necessary information about product eligibility and rules at their fingertips, which helps to keep conversations and recommendations compliant. Interactive guides also help ensure that the notes and information your employees collect about customers are handled in a compliant way.

Rather than contributing to the information sprawl from unstructured content, your customer’s information remains housed in a compliant, accessible database. A digital conversation guide helps manage information governance in a more efficient, seamless and automatic way.

“Digital guides allowed a new employee to succeed day one. This is huge for maintaining retention and reducing training costs.”

—Large Midwest Financial Institution

Contact us today to learn how digital conversation tools can help you improve employee engagement and turn bankers into Power Bankers. Or download our case studies eBook to discover the success other banks have had with this technology.